irs tax act stimulus checks

Third Stimulus Check in 2021 Under Biden COVID Relief Package. 1200 in April 2020.

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc7 Chicago

The Consolidated Appropriations Act 2021 added additional funds to this credit which basically serves as a second stimulus payment for most taxpayers.

. The Recovery Rebate Credit was added for 2020 as part of the CARES Act to reconcile your Economic Impact stimulus payment on your 2020 tax return. In the somewhat longer words of the IRS. Theres been some confusion over a math error notice issued by the IRS.

Up to 10 cash back August 20 2021. In the meantime the IRS is sending third stimulus checks for up to 1400 apiece to people who qualify for the new eligibility rules and income limits. Those offsets will be suspended through Sept.

IRS has several online resources to help taxpayers. Tax preparation company Jackson Hewitt said the Internal Revenue Service sent payments to an estimated 13 million banks accounts that are no longer open or valid. You can check the status of your payment with the IRS Get My Payment tool.

TaxActs free Stimulus Registration service has been designed to help millions of Americans submit their information to the IRS in order to receive their stimulus payment also known as the Economic Impact Payment. Under the now passed 19 Trillion Biden COVID Relief Package American Rescue Plan ARP there are provisions included for another third round of stimulus checks. The American Rescue Plan Act ARPA of 2021 expands the CTC for tax year 2021 only.

COVID-19 Stimulus Checks for Individuals. That stimulus bill was approved for 2 trillion enough to provide most American families with direct payments of up to 1200 per taxpayer. No the payment is not income and taxpayers will not owe tax on it.

The CARES Act calls for no other specific offsets to the stimulus checksAnd it grants some relief to those whose Social Security retirement payments are being garnished for other reasons such as delinquent student loan debt or food stamp overpayments. Those stimulus checks are also referred to as economic impact payments or recovery rebates. Must file a 2020 tax return to claim if eligible.

The latest stimulus payments as part of President Joe Bidens American Rescue Act sent 1400 checks to Americans. Families who receive the CTC. Recipients received them by.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. As people start to spend their money some wonder. The amounts will be 2800 for couples 1400 for single adults and 1400 for each eligible dependent per the final bill crafted.

The first stimulus package included 1200 in direct payments and the next one sent 600 to Americans. The IRS has agreed that it will not offset your stimulus rebate to pay for federal tax debts but the agency cannot extend this discretion for. Prepare and file your federal income tax return for free.

The IRS started sending them out in late December 2021 continuing into January saying 2021 Total Advance Child Tax Credit AdvCTC Payments near the top and Letter 6419 on the bottom. Is my stimulus payment taxable. Alternatively eligible people who dont normally have to file a tax return and who didnt file a 2019 or 2020 tax return or use the Non-Filers tool fo.

Some individual states also issued aid to residents. The IRS will issue the stimulus payments through direct deposits and mailed checks. This year individual tax.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. 7 hours agoThe latest amount that has been floated as a potential payment is 0 per person Second stimulus check update. Technically they served as an advanced tax credit on your 2020 income taxes.

Some wont get 0 check and will have to wait for tax time who queries the Get My Payment site and gets the response Payment Status 2 Not Available The Economic Impact Payment letters include important information that can help people quickly. Below is all the information you need to know for stimulus check registration during the coronavirus crisis. Families receiving monthly Child Tax Credit payments can now update their mailing address using the IRS Child Tax Credit Update Portal.

If you didnt get a first and second Economic Impact Payment or got less than the full amount you may be eligible toclaim the 2020 Recovery Rebate Creditand must filea 2020 tax return. The payment was in addition to the child tax credit payments that began in July 2021 offering up to 300 per month per child to qualified parents. En español The Internal Revenue Service IRS is sending out millions of checks in the third round of stimulus payments.

Of note the IRS is also using information from this seasons returns to process the new 1400 stimulus checks or potentially top up those payments. That was the third round of stimulus checks issued amidst the ongoing Covid pandemic. 2020 Recovery Rebate Credit.

Millions of Americans received stimulus checks in 2021. Updating address information will help avoid mailing delays or returned payments for families who choose to receive their payment by paper check. It will show you both how and when you will receive your stimulus payment.

1400 in March 2021. 600 in December 2020January 2021.

How To Claim A Missing Stimulus Check

Americans Struggle To Receive Missing Stimulus Checks

Third Stimulus Check Will It Be Based On 2019 Or 2020 Taxes Kare11 Com

Stimulus Checks Tax Returns 2021

Your 2020 Stimulus Check How Much When And Other Questions Answered

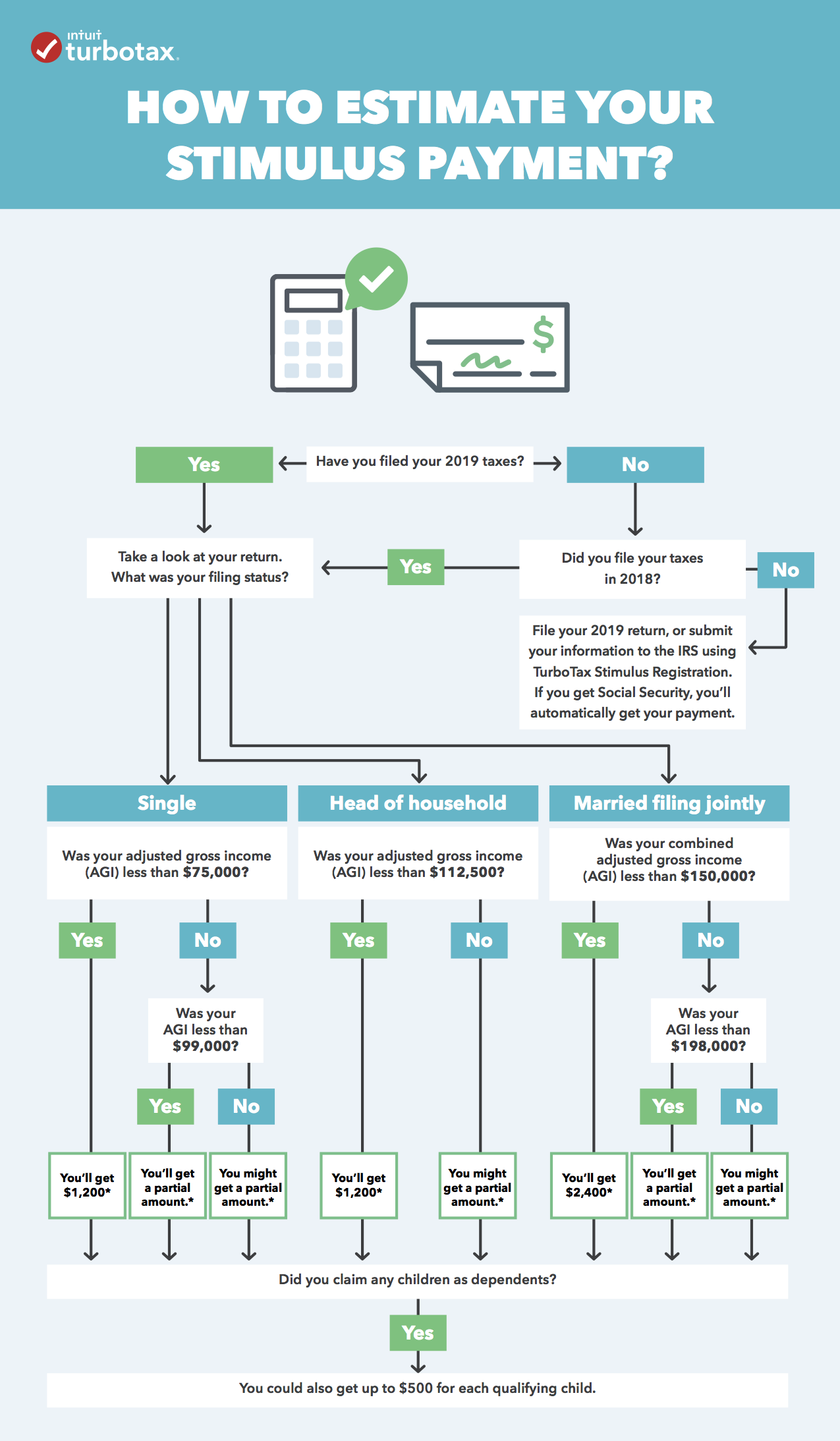

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

Irs Get My Tax Refund Claiming Stimulus Check On 2021 Return Abc7 Chicago

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs The Washington Post

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return King5 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Key Dates For The Next Set Of Stimulus Payments The Washington Post

Here S Why Some People Need To Return Their 1 400 Stimulus Check To The Irs Silive Com

Do You Have To Pay Back Stimulus Checks To The Irs In 2022

Details On The Second Stimulus Check

Is A Fourth Stimulus Check Arriving In 2022 Al Com

Which Irs Stimulus Check Tool Should You Use

Stimulus Checks Irs Letter Explains If You Qualify For Recovery Rebate Credit Fox31 Denver

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor